New tax will impact purchasing prices on foreign websites

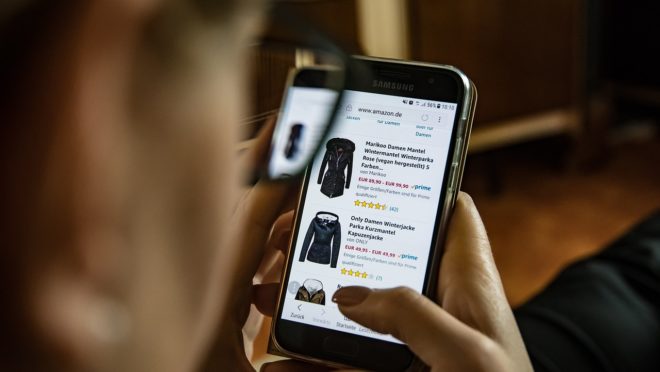

The new Value Added Tax (VAT) provided for in tax reform will be charged for all purchases of products and services made through digital platforms, such as Shein, Shopee and AliExpress, whether based in Brazil or abroad.

Taxation will apply to purchases of all values, including those up to US$50 – which are currently exempt from Import Tax, which is federal, in the case of websites participating in the Conform Shipping program. Transactions of more than US$50 already pay Import Tax of 60%. Other than that, all purchases – above or below US$50 – pay state ICMS of 17%.

What changes with the reform is that there will be both regional and federal taxes on all purchases, regardless of the value. This is because the VAT will be the combination of a new federal tax (the Social Contribution on Goods and Services, CBS) plus the Tax on Goods and Services (IBS), under state and municipal jurisdiction.

With the reform, purchases must pay the standard “dual VAT” rate (that is, the sum of CBS and IBS), estimated at 26.5%.

At a press conference on Thursday, the extraordinary secretary for tax reform, Bernard Appy, said that the difference in relation to the current rate will be small.

“Today it is already being taxed with ICMS at an ICMS rate of 17%, which, on the outside, amounts to 20.5%”, said Appy, according to a report in the newspaper “O Estado de S. Paulo”. “The states are talking about increasing (the ICMS rate on online purchases from foreign websites, currently 17%) to 25%. On the outside, this is a rate of 33%. In other words, it is more than we will tax (after the reform). Compared to what we have today, the difference will be minuscule”, stated the secretary.

The change in the consumer’s pocket will be felt from 2026, when VAT starts to be charged.

Taxation on online purchases is provided for in complementary bill regulating tax reform. According to the proposal, any purchase of products and services through digital platforms, including foreign websites, will be subject to VAT. There will be no distinction in charging amounts.

The government text replaces the current consumption taxation with three taxes: the Social Contribution on Goods and Services (CBS, federal); the Tax on Goods and Services (IBS, which is the responsibility of states and municipalities); and the Selective Tax (IS, federal, nicknamed the “sin tax”).

According to the proposal, the new VAT rules do not change the Import Tax, a tax that was not included in the tax reform and which continues to be exempt up to US$50. However, in addition to the VAT, goods purchased abroad may pay an import tariff which can be changed at any time by the government by decree.

Post Comment